year end accounts extension

You will also need to file a directors report unless your company is a micro-entity. Review end-of-year checklist for Bookkeeper Review end-of-year checklist for County Program Director Report configurations for MCHCP University Subsidy.

How Many Times Can You Extend Your Ppf After Maturity Mint

15 C Corporation Fiscal Year End other than Dec.

. The deadline to submit 2021 tax returns or an extension to file and pay tax owed this year falls on April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbia. This extension includes dormant company account too. Apply to extend your accounts filing deadline Use this service to apply for more time to file your annual accounts with Companies House.

Tennessee Extension Master Gardener Program 2016 Annual Year-End Financial Summary Organized as a separate 501c3. 7999-Fee Generation expense account. So accounts will be due on Monday 31st.

Filing Company Year End Accounts with HMRC. 2 days agoThe IRS can also issue a late-filing penalty of 5 of the amount due for every month or partial month your tax return is late. Taxpayers in Maine or Massachusetts have until April 19 2022 to file their returns due to the Patriots Day holiday in those states.

The purpose of this letter is to compile reporting information provided throughout FY 2020-21 and provide contractors the due dates and reporting requirements for purposes of completing year-end and audit reports for the fiscal year ending June 30 2021. You will need to file your company tax return also known as the CT600 form online. I have a client with a 3112021 year-end that we already have been granted a 3 months extension.

You will have 12 months to submit your accounts instead of the standard 9 months filing deadline. You have a clear outline of what you want to achieve which tends to result in less stress and quicker outcomes. Companies House will extend your filing deadline to 31 March 2021.

Generally companies can lengthen their accounting period to a maximum of 18 months and unless certain criteria apply the financial year can only be lengthened once every five years. NEW employee co-pay or deductible reimbursements. Setting SMART goals gives you focus and direction.

For examples a private limited company with an accounting year-end date of 31 March 2020. Its purpose is to review the accounting records and financial statements prepared by the treasurer for. 31 or June 30 15th day of 3rd month after year-end 15th day of 9th month after year-end.

For more information or help on starting the new year right contact me at mburrowumnedu or Houston County Extension at 507-725-5807 or Fillmore County Extension at 507-765-3896. To do this you will need your company accounts and your corporation tax calculation. Yes Companies House say that the extension from 9 months to 12 months for a private limited company to file accounts at Companies House applies where the ordinary 9 month deadline would fall on or before 5 April 2021 and on or after 27 June 2020.

15 April 15 Oct. To a maximum of 18 months or longer if your companys in administration once every 5 years You can only lengthen the financial year more often than every 5 years if. If your return is.

Not prior to June 30 2014. Process fiscal year-end close first thing in morning. By way of example if a public companys accounting reference period ends on 1 December 2019 meaning its usual deadline to file the companys accounts at Companies House would be on or before.

June 30 year-ends including those with other fiscal year-ends will be due on the 15th of the 4th month after the year-end. Companies may change their year end by shortening their financial year by a minimum of one day as many times as they like. Fiscal Year-End process should be completed after all FY14 transactions have been processed and reports have been archived.

Generally companies can lengthen their accounting period to a maximum of 18 months and unless certain criteria apply the financial year can only be lengthened once every 5 years. Client has had difficulties with his records and we would like a little more time. If you have any unbilled invoices dont wait any longer to send them.

25 March 2020 From today 25 March 2020 businesses will be able to apply for a 3-month extension for filing their accounts. This joint initiative between the government and Companies House will. Companies may change their year-end by shortening their financial year by a minimum of 1 day as many times as they like.

Depending on the size of your company you. Please share this letter with your agency staff. Ad e-file Your 6-month IRS Federal Tax Extension Online In Just A Few Minutes Today.

The company is in. 03rd Jul 2020 1101. A six-month extension is allowed from that date.

Private limited companies LTD accounts. Class Code Structure Apply class 4000 to savings and investment bank. Backups are done daily at 530 pm.

Minus all expenditures must equal the treasurers total balance at the end of the year bank balance plus. Revenue Expense Summary. For funds with an annual or half-yearly accounting date after 30 September 2020 the temporary relief will expire and no extra time will be provided.

A company can shorten its accounting period as many times as it likes but it can only lengthen it once every five years or to be more exact notice cant be given to extend an accounting period if it is within 5 years of an accounting period which has been extended. One of the most important aspects of closing out your businesss financial year is making sure all income and expenses are recorded and up to date. This will bring an end to the temporary relief.

Replying to lionofludesch. Get all unbilled projects and orders invoiced immediately. We will expect relevant reports to be published in line with the usual timelines see existing timeframes in our statement below.

A subsequent letter will be issued in the. Step Time Frame Possible Extension Preparation of financial statement 5 months after the year-end 11 months after the year-end Adoption of accounts by shareholders general meeting Within 2 months after the preparation Filing of the accounts at the Chamber of Commerce 8 days after the adoption by the general meeting of shareholders.

Important Statutory Due Dates For Llp Annual Filing Fy 2020 21 Ebizfiling

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Udemy 100 Free Tax Adjusting Entry Year End Accounting Excel Worksheet Udemy Coupon Accounting Udemy

Accounting For Senior Cycle New Fourth Edition 2021 In 2022 New Students Student Activities Textbook

Understanding Profitability Ag Decision Maker

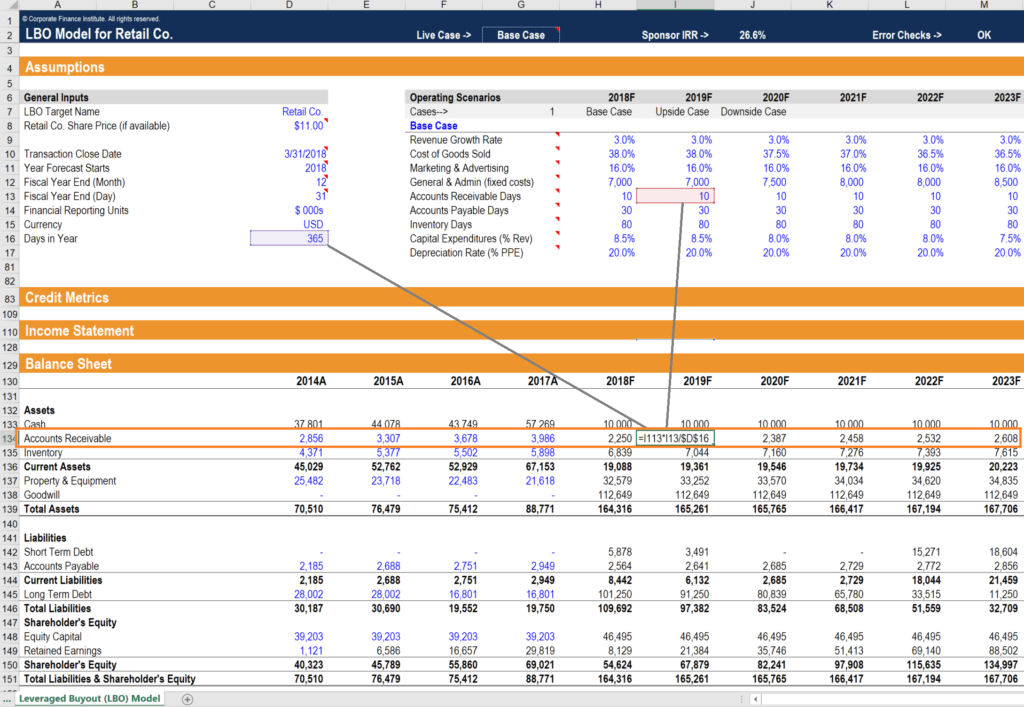

Accounts Receivable Turnover Ratio Formula Examples

Accounts Receivable Turnover Ratio Formula Examples

/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

Explain How Notes Receivable And Accounts Receivable Differ Principles Of Accounting Volume 1 Financial Accounting

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

Capital Budgeting Basics Ag Decision Maker

Your Accounting Basics Psa You Have One Week To File Your Taxes If You Filed An Extension The Countdown Is On Acc Tax Extension Tax Time One Week

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Understanding Profitability Ag Decision Maker

Understanding Profitability Ag Decision Maker